Yes Bank Credit Card Bill Payment

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

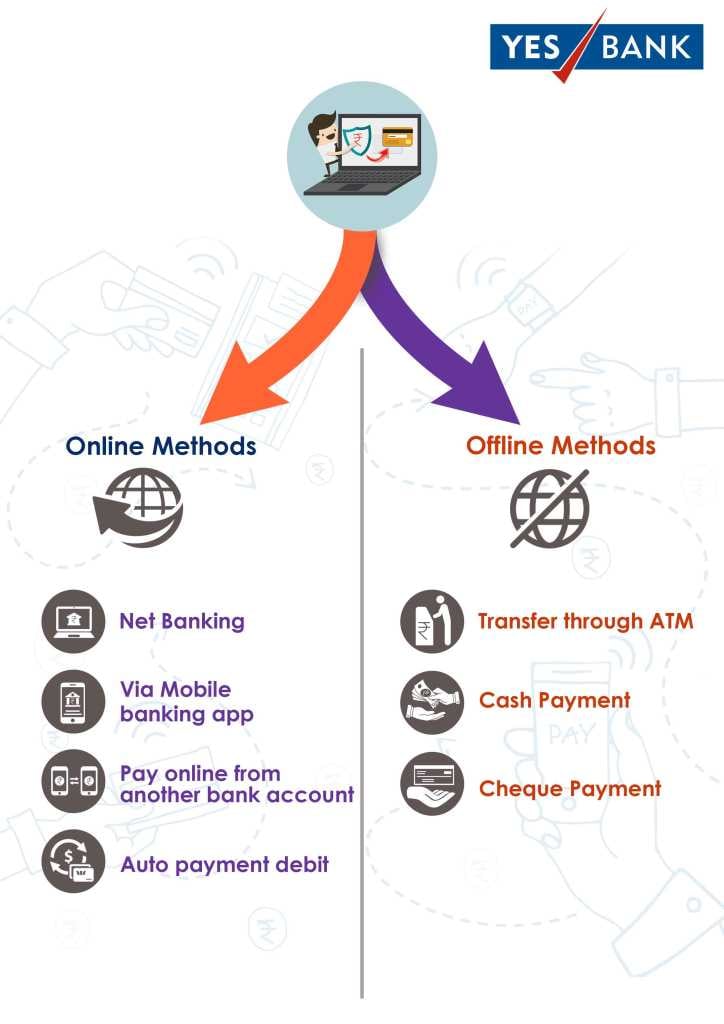

It's vital to pay credit card bills before the due date to avoid high interest rates and a slump in your credit score. That's why Yes Bank presents several payment avenues for the customers to help them in clearing their outstanding balances. The customers can access most of these channels even if they are not a Yes Bank savings account holder.

Online Bill Payment Modes

-

Net banking

-

Standing instructions

-

NEFT/IMPS/RTGS

-

YES Mobile App

-

YES Pay App

-

YES ROBOT

Offline Bill Payment Modes

-

ATM funds transfer

-

Cheque payment

-

Cash payment

Offline Modes of Credit Card Bill Payment

Net Banking

- If you're a Yes Bank account holder, you need to register yourself for the net banking facility through your customer ID and password.

- After registering on the net banking portal, add your credit card details as a biller by clicking on the "Add Biller" option, and wait for the request to get processed.

- Initiate the bill payment towards your credit card.

- After completing the transaction, you will get an acknowledgment receipt via email or SMS.

Standing Instructions

Through the standing instructions, a predetermined amount will be debited from your bank account every month towards your credit card bill payment. It will save you from the hassle of keeping track of your due dates. You can modify and delete your existing standing instructions as per your convenience.

NEFT/IMPS/RTGS

You can transfer funds from other bank accounts to your credit card account with NEFT/IMPS/RTGS. For using this payment mode, you will have to follow specific steps:

-

Add "Yes Bank credit card" as a beneficiary.

-

Use the IFSC code "YESB0CMSNOC" for completing the process.

YES Mobile App

Download the YES Mobile App from the google play/ app store to initiate payments towards your credit card. Use your mobile number to register for the app. Here are the steps of registration:

-

Sign in with your net banking credentials.

-

Enter your debit card number and PIN, or else you can enter your customer ID, birth date, and PAN number.

-

Once your details are validated, an OTP will be sent on your registered mobile number.

-

Enter the OTP details.

-

Once the mobile number is verified, you can set a six-digit MPIN.

-

You can also use fingerprint authorization if your iOS or Android phone has a biometric feature.

YESPay App

You can also sign up for YESPay app to make payments. Download the app from Google Play Store/iOS App Store. You will have to fill specific details to complete the registration process. YESPay provides you access to a prepaid wallet or UPI and make credit card payments.

YESROBOT

YESROBOT is an AI-powered chatbot that helps you with all financial transactions. Here are the steps to use it:

-

Install the Facebook Messenger.

-

Search for YES ROBOT on the messenger.

-

Start chatting by typing 'Hi.'

-

Enter your customer ID and mobile number to register yourself.

-

An OTP will be sent on your registered mobile number.

-

After the validation of the mobile number, you will be able to use this facility for non-financial transactions.

-

For financial transactions use your MPIN.

-

Once your account is successfully authenticated, you can start paying your bills instantly.

Offline Modes of Yes Bank Credit Card Bill Payment

Atm Funds Transfer

Visit the nearest Yes Bank ATM to use this payment mode. Follow the instructions appearing on the screen to transfer funds from your savings/current account to your credit card account.

Cheque Payment

Write a cheque to your credit card account by mentioning your 16-digit card number on it. Drop the cheque at the nearest Yes Bank's drop boxes. It's vital to mention your full name and the mobile number behind the cheque.

Cash Payment

If you are not comfortable using any of the above modes, then choose cash payments. Visit your nearest Yes Bank branch to use this payment mode. You will be charged a processing fee at the bank.

FAQs

If a wrong credit card number has been entered, what should a customer do?

The credit card number should be entered twice for security purpose. If it is still entered incorrectly, then the customer should call the customer care.

How can offline payments be made?

It can be paid by cash or cheque either at the nearest ATM or nearest bank branch.

How can credit card bill payment be made through mobile?

For paying credit card bill through your mobile, you have to download the bank's app, go to the credit card section and initiate the bill payment.

When a payment is made towards YES Bank Credit Card, how much time does it take to get credited in the account?

The payment is credited in two days.

What are the monetary limits on the mobile wallet of YesPay?

The limits vary as per the customer. For instance -

-

If you are a minimum KYC customer:

Your wallet balance limit: Rs.10,000

Monthly spend limit: Rs.10,000

The amount loaded in a financial year: Rs.1 lakh

-

If you are a full KYC customer

Wallet balance limit: Rs.1 lakh.

Is there any fee for using Yes Bank's net banking services?

No. If you are an account holder, then you will not be charged anything for using Yes bank net banking services.

®

®