EPFO

EPFO or Employees’ Provident Fund Organisation is a statutory body which comes under the Ministry of labour and employment, created by the Government of India. It has been established to assist the Central Board of Trustees and is India’s largest social security organisation as it undertakes a large number of beneficiaries and covers high financial transaction volume. EPFO is also the centralized agency for execution of bilateral social security agreements with other countries.

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

Under ‘The Directives Principles of State Policy,’ the Constitution of India has set the guidelines for every state for making effective provision to secure the right to work, to education and assisting public in cases of unemployment, sickness and disability. EPF came into existence with the enactment of Employees provident fund Ordinance in 1951. This bill was introduced in 1952 for the provision of provident fund to employees working in factories. The Employees’ Provident Funds and Miscellaneous Provision Act were enacted in 1952 as the law to govern EPF by the Parliament, which is applicable everywhere in India except Jammu & Kashmir. Under this act, all the schemes get administered by a governing body - The Central Board of Trustees - which takes all relevant decisions for the execution and implementation of different schemes under the programme.

There are several EPF forms available on the EPFO site which can be accessed by the employees under different circumstances.

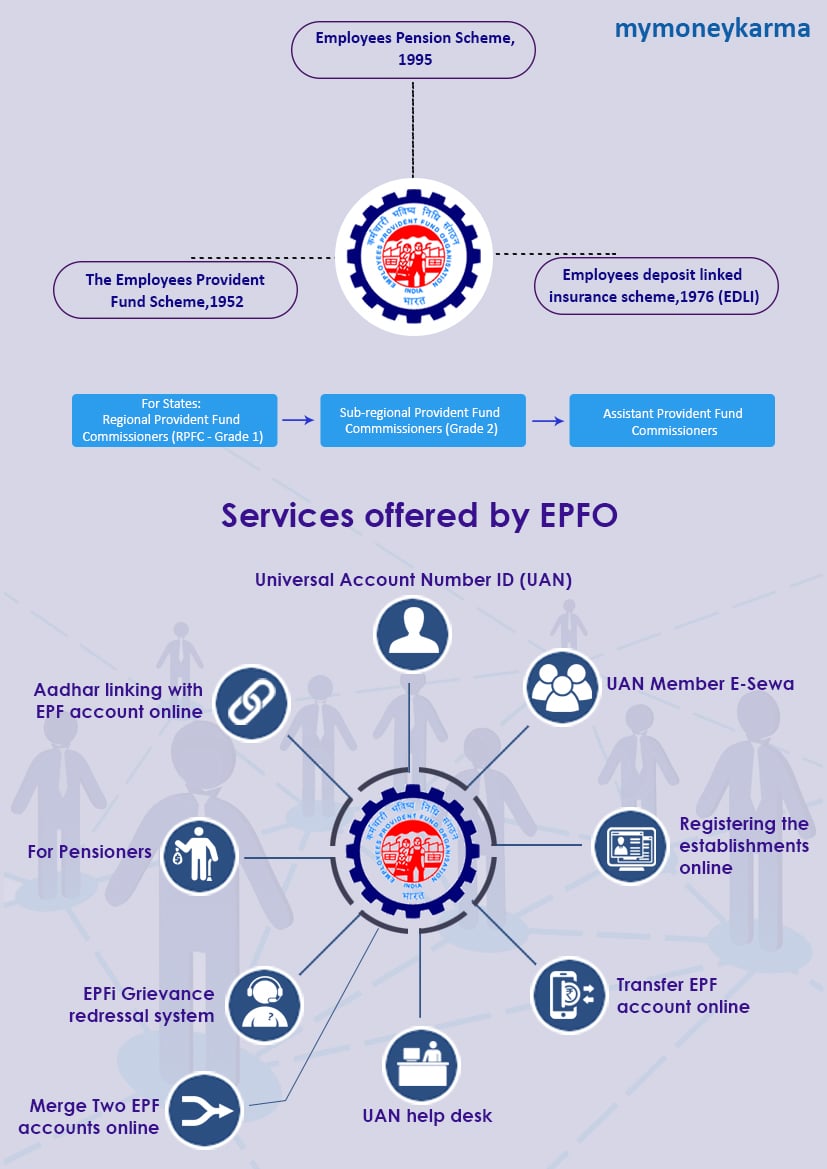

Structure & Function of EPFO:

The Central board of Trustees (CBT) has representatives from Central as well as the State governments, including Employers and Employees. It is presided over by the Ministry of Labour and Employment.

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

The CBT takes care of the execution of three schemes:

The Employees Provident Fund Scheme, 1952

The Employees Pension Scheme, 1995

The Employees Deposit Linked Insurance Scheme, 1976 (EDLI)

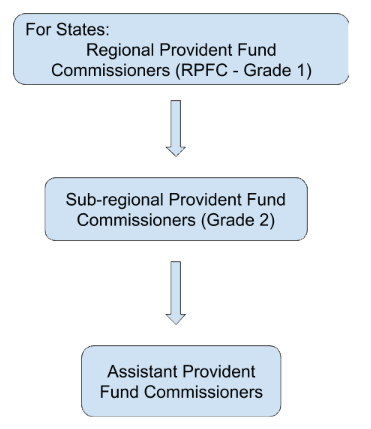

EPFO’s work is segregated into different zones chaired by the Additional Provident Fund Commissioner in every state of India. Each state contains a Regional office headed by The Regional Commissioners (RPFC, Grade 1)

There is an enforcement officer for district offices, who looks after local establishments and grievance redressal.

The functioning of EPFO includes the imposition of the act all over the country except Jammu and Kashmir, individual accounts maintenance, claims settlement, funds investment, instant payment of pension and records updation. EPFO has adopted several IT enabled tools and techniques along with various digital initiatives to simplify EPF accounts for employers as well as employees.

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

Services offered by EPFO:

List of factories explaining the type of establishments, which are following the rules and regulations mentioned in the act in detail, comes under schedule one of the Employees’ Provident Funds and Miscellaneous Act,1952. Companies having more than twenty employees mandatorily need to take part in this scheme in which most of the activities can be done online as alleviated by EPFO. The online services provided by EPFO are as follows:

Universal Account Number ID (UAN):

EPFO introduced UAN for all of its members. This number allows the transfer of PF accounts from one employer to another removing the dependence of an employee on the employer for EPF balance withdrawal. This number is unique and allows it’s member to check all EPF accounts from different employers. A member can also close the old account and transfer balance into a new one through this number, but the number provided by the employer needs to be activated.

There are five steps to activate the UAN number:

Get the UAN and member id from the previous employer for activation.

Visit the EPFO website and press “activate your UAN based registration button” which will navigate to the instructions page. Read the instructions and select “I have read and understood the instructions.”

Enter your UAN, member ID and mobile number and select your State and PF office from the drop-down options. Then click on “Get pin” after completion of entering your details.

A pin will be sent to the registered mobile number which needs to be entered for activation.

After activation, create a user id and password for using UAN services provided by the portal.

UAN Member E-Sewa:

Now employees can register for e-sewa service using their UAN number. Through this sewa, employees get access to various services such as UAN card download, KYC information update, getting account passbook linked via UAN, etc.

Registering the establishments online:

The companies could register through Online Registration of Establishments Portal (OLRE). This online portal has been introduced for allocation of PF codes. Any queries about registering online and getting PF codes can be sorted by reaching to helpdesk number 1800118005 which is available on all working days from 9:45 a.m to 5:15 p.m. For the application process, employers need to upload a digitally signed document along with PAN details which will also get verified. The establishments who are eligible for this process can be categorized into:

Those listed under the list of factories provided as per PFMPA, 1952

Those who don’t come under the eligibility criteria but have a majority of employers and employees who wish to participate.

Those establishments who already have a PF code but need another one for their sister concern or branch.

Transfer EPF account online:

This procedure is to increase transparency for employees to get accounts transferred and make submission of transfer claims from previous or current employer convenient through the portal. The digital signature of the authorized person is mandatory for this particular process.

UAN help desk :

For employers, there is a separate UAN helpdesk, where the employers can register by providing information such as establishment id, PF office address, extension code if any and the registered mobile number as per ECR portal.

EPFi Grievance redressal system

There is a portal known as grievance management system (EPFi) for the employees who are looking for a solution to their grievances. A grievance can be registered by filling the registration form online where the information status (Employer, Pensioner, Employee), the name of the organization, address, EPFO office, name and address of the complainant, phone number and mail id need to be filled. The sub-categories which can be chosen under this category are Final settlement/PF withdrawal, transfer of PF accumulations (F-13), scheme certificate (10C) pension settlement (10D), PF balance issue, insurance payment benefit, etc. Once the complaint has been registered and if no response has been received, a reminder can be sent to the organization through the same portal.

For Pensioners:

Pensioners can also access the portal to inquire about their pension. There are few details which need to be filled for this process like the address where the establishment is present, date of birth, code of employer. Submit the query to get further details.

Get your free Credit report that cost

Rs 1200 for FREE1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

Aadhar linking with EPF account online:

EPF helps employees in saving some amount of their salary, which they receive at the time of their retirement. The savings under it are tax-free. Aadhaar-EPF linking makes the procedure of detail verification a lot easier for the account holders.

Now how to link Aadhaar with EPF - here is the process:

EPFO: link your UAN with Aadhar

Fill your UAN and mobile number details to generate OTP.

Type the OTP you received on your mobile number and select your gender.

Put the Aadhaar number in the next step and click on “Aadhaar verification” method. There are two options to choose from:

e-mail/mobile based OTP.

By using biometric.

Select the option 1 to complete the verification method.

For knowing more about the benefits of Aadhar Card Linking

Merge Two EPF accounts online:

Open the website of EPFO.

Select “services”.

Select “one employee-one EPF account” in service tab.

Enter details such as UAN and phone number.

Select “generate OTP” and the OTP will be sent to your registered mobile number.

Verify OTP after filling the details.

Put the details of old EPF account you are looking to merge.

The declaration needs to be accepted for the completion of the process.

Faq's on EPFO

There are four ways to check the PF balance:

Using EPFO portal: PF passbooks can now be accessed on another website run by EPFO,instead of unified portal which still can be used for transactional facilities like transfers.To check passbook,account need to be tagged with UAN.The passbook can either be downloaded or printed from website(www.epfindia.gov.in) after going to Service tab

Sending SMS:To avail this procedure,UAN should be registered with EPFO,after which you can get the details of the PF balance by sending SMS to 7738299899 as EPFOHO UAN ENG where ENG are the first three characters of preferred language.This facility is available in several languages.So link your UAN with aadhar,PAN and bank accounts or else ask your employer to do it to avail facility.

Give miss call on 011-22901406 from registered mobile number to fetch the details.

Use EPFO app:For this EPFO m-sewa app can be downloaded from google play store.After downloading select“member” and click on “balance/passbook” to enter UAN and registered mobile number.

To provide ease of governance and compliance,EPFO has started several initiatives recently like Pensioners portal launch on their website and introduction of new services like UAN-Aadhar linking for easing the process for their members.Here are some of the initiatives:

Pension passbook for Pensioners:

This service can be availed via Umang app.To view pension book, the person need to click on “View passbook” and submit PPO number and date of birth after which OTP will be sent to registered mobile number.EPFO is providing lots of e-services through Umang app like employee centric services,employer centric services,pensioner services and e kyc services.

Pensioners portal on EPFO website

EPFO members will be informed about contributions which has not been made by Employers through SMS or e-mail if the mobile number or email is registered with UAN.Credit info is also available through Umang app

EPFO is planning to give options to members for increasing or decreasing PF investments in stocks through exchange trade funds(ETF) from PF accounts in current financial year to provide better returns in which the fund body is planning to credit investments in members account within in three months.

E-nomination facility launch:

EPFO has introduced e-nomination facility for its members for filing nomination form.

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs