Standard Chartered Bank Credit Card Bill Payment

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

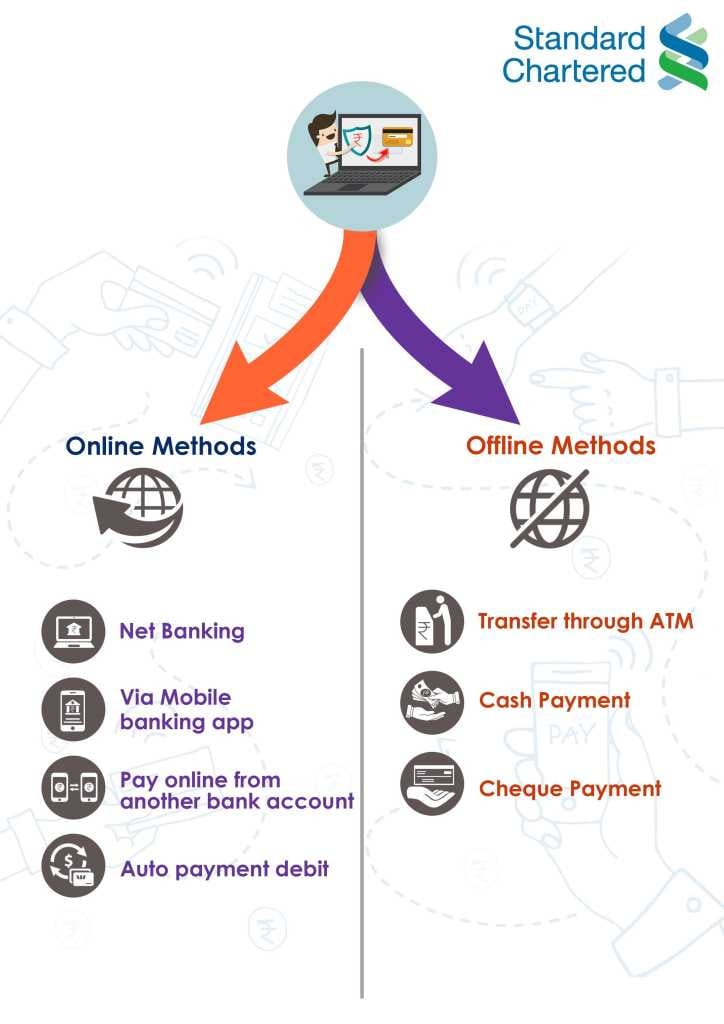

Standard Chartered Bank has customized credit cards to cater to various needs of people, such as shopping, travel booking, hotel booking, and corporate cards as well. There are different rewards and benefits associated with Standard Chartered Bank credit cards. Standard Chartered Bank also provides multiple options in both modes of payment to its customers.

-

Online Method

-

Offline Method

Online Method

-

Standard Chartered Bank Net Banking: Net banking facility can be availed by users only after registering online. To check the outstanding of credit card and to pay bills, the user is required to link their credit card with their net banking account, for which ATM pin details would be used. After linking the Standard Chartered Bank credit card with net-banking account, the user would be able to check billed or unbilled transactions, due dates, reward points, etc. by simply logging on to the net banking account through the bank’s website, clicking on the “credit card” tab and selecting “credit card payment” option. Standard Chartered Bank also provides hot listing facility under net banking to block it from any misuse in case the card has been lost or stolen.

-

Standard Chartered Bank Mobile App: For this procedure, users need to download and install Standard Chartered Bank’s app on their phones. After installation, users can login to the app by using their customer ID. The app has been made for the convenience of mobile users; it provides the same features as that of the net banking portal, so that it may be accessible from anywhere. Credit card accounts are highly secure through 128-bit SSL protection. Thanks to this feature, users can conduct transactions without risk of fraud using their accounts from practically anywhere through a mobile app.

-

Auto payment debit: If a user has multiple credit cards, an auto debit option is available for payment of credit card bills. To use this facility, certain instructions need to be set on the concerned Standard Chartered Bank savings account. This facility is used to pay the minimum amount or to repay the entire outstanding balance.

-

Credit card payment from non-Standard Chartered Bank accounts: It is not mandatory to have an account in the same bank whose credit card you are using. There are different ways of paying credit card bills through other bank accounts:

-

NEFT method: In this method, the user needs to enter the number of the Standard Chartered Bank credit card as the payee account number as well as the corresponding IFSC code to make credit card bill payments. The payments that are made during working hours on weekdays get transferred on the same day, whereas the payments that are made after working hours get transferred on the next day.

-

RTGS (Real time gross settlement) method: This method is applicable for the people who use a credit card for higher transaction amount, as they can pay the whole amount at one time. For carrying out this transaction, net banking should be activated in the other bank account too.

-

Bill desk webpage: Bill desk page can also be used by non-Standard Chartered Bank account holders. The user needs to enter the necessary details, like the card number and the amount, after which, the user is redirected to the concerned net banking portal to complete the transaction.

-

Online non-Standard Chartered Bank portal : Login to the online portal using net banking id and password for settling payments.

-

Offline Method

-

Cash Payment: Credit card bills can be paid in cash at the nearest bank branch of Standard Chartered Bank by paying processing fee.

-

Cheque Payment: Credit Card bill payment can be done through cheque by dropping it at the nearest ATM or cheque drop box, after writing the credit card number and other details on it.

-

Transfer through ATM: Standard Chartered Bank credit card bill can be paid through ATM transfer at any of the bank’s ATMs. This service can be availed 24/7. Here, the amount that is required to be paid can be transferred from savings or current account to the credit card account.

FAQs

If a wrong credit card number has been entered, what should a customer do?

The credit card number should be entered twice for security purpose. If it is still entered incorrectly, then the customer should call the customer care.

How can credit card bill payment be made through mobile?

For paying credit card bill through your mobile, you have to download the bank's app, go to the credit card section and initiate the bill payment.

Is there any limit set by Standard Chartered Bank for online payment of credit card?

Yes, the amount being paid should be equal to the total amount due as per the statement.

What's the maximum amount that can be paid using Visa Credit card payment and are there any charges?

The maximum amount to be paid through this facility is Rs.49,999/- per transaction and a maximum of Rs. 1 lakh can be transferred in a day.

®

®