SBI Credit Card Bill Payment

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

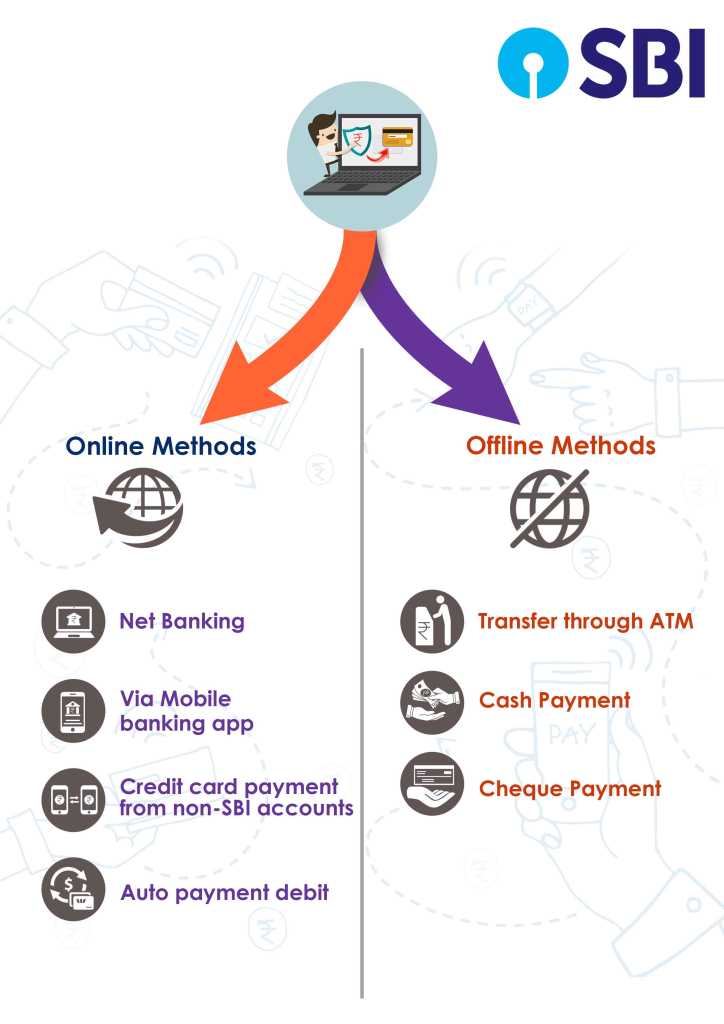

Paying credit card bills on time can increase your credit score. SBI provides numerous methods to pay SBI credit card dues as per your convenience. SBI offers two different modes of payment, i.e., online and offline. Each method has got a different payment processing time. So, you need to know the methods well before initiating a credit card bill payment. Let us go through these quick and easy methods in detail.

Online Methods

Here is a list of all the online methods available to pay SBI credit card bills:

SBI Online

This method is available for SBI account holders. Follow these steps to complete the payment:

-

Login to onlinesbi.com and select 'Bill Payments.'

-

Enter 'Manage Biller' and then select the 'Add' tab.

-

Now, opt for 'All India Billers.'

-

Select 'SBI Cards and Payment Services Pvt. Ltd'.

-

In order to register the biller, submit the required details and verify the transaction with an OTP.

-

After the transaction is complete, you can view and pay your bills.

-

Now, select 'View/pay bills' and choose 'Without bills.'

-

Select 'SBI Card' and make the payment.

Paynet-Pay Online

Paynet-Pay Online facility can be availed by either using your SBI net banking account or even without it. Follow these steps to pay your credit card bill using Paynet- Pay Online:

Using SBI net banking

Log in to your SBI net banking account and select the option 'Pay Now' on the dashboard.

Once the payment is done, you will get the transaction reference number.

Without using SBI net banking

-

Visit https://www.billdesk.com/pgidsk/pgijsp/sbicard/SBI_card.jsp.

-

Enter the required details and complete the payment.

Mobile Banking

You can also pay your SBI credit card bills using mobile banking application. To avail this facility, your SBI credit card must be registered with the application.

-

Log in to the mobile banking account.

-

Select the 'Pay now' button located at the bottom of the 'Account Summary' page.

-

Enter your mobile number and email ID if they are not registered.

-

Enter the transaction amount.

-

From the drop-down menu, choose a payment option and the bank name.

-

Confirm the details, and then you will be redirected to the payment interface.

-

Authorize the payment, and you will receive the transaction reference number.

Auto Debit

You must register to use the auto debit facility to pay your credit card dues.

-

Get the Auto Debit form

-

Fill the form and send to the address mentioned in the form.

Here, you have the option to choose between the total amount due and the minimum amount due that you want to pay through auto-debit every month.

National Automated Clearing House

You have the facility to authorize SBI to deduct the credit card dues from your account directly by availing the services of National Automated Clearing House (NACH). The amount gets debited every month, and hence your credit card account gets credited by the due date.

-

Visit https://www.sbicard.com/sbi-card-en/assets/docs/pdf/forms-central/nach.pdf to enroll for the NACH services.

-

Fill the form and send it to the following address:

SBI Card and Payment Services Pvt. Ltd.

P.O. Bag No.28, GPO,

New Delhi - 110001

SBI Debit Card

You can also pay your SBI credit card outstanding balance using your SBI debit card. Follow the steps mentioned below:

-

Go to https://www.billdesk.com/pgidsk/pgijsp/sbicard/SBI_card.jsp

-

You can now enter your SBI credit card number and the required details.

-

Click on 'Pay Now' and initiate the transaction.

-

Enter the password and complete the payment.

UPI Apps

You can also pay your SBI credit card dues through UPI. Download the BHIM SBI Pay app, register, create a virtual payment address and generate the PIN. Follow the steps mentioned below to pay through BHIM:

-

Select 'Pay by VPA' (Virtual Payment Address). It refers to the 16-digit number of your SBI credit card.

Example: Sbicard.4726420323456789@SBI

-

Enter the transaction amount and select 'Go.'

-

Enter the MPIN and select 'Submit.'

-

The payment status will reflect immediately in your account.

SBI YONO App

You must download the YONO application and register on it using your net banking or debit card number to use the facility.

-

Log in to the application.

-

Select 'My Credit Cards' under 'My Relationships.'

-

Now, select your SBI credit card.

-

Enter the required details and initiate the payment.

-

Payment will be reflected immediately on your credit card account.

Electronic Bill Payment

This service can be availed through ATM, internet banking, or mobile banking services of SBI.

-

Log in to your internet banking account.

-

You must add your SBI credit card as a biller.

-

Fill in the required details and make the payment.

Paytm

Follow these steps to pay your SBI credit card dues through Paytm:

-

Under the 'Credit Card Bill Payment,' enter your SBI credit card number and click on proceed.

-

Select the payment method between BHIM UPI and net banking.

-

Click on 'Pay now.'

-

Fill in the required payment details and complete the transaction.

Offline Methods

SBI provides convenient methods for customers who want to pay their SBI credit card bill offline. List of the different methods is as follows:

Counter Payments

-

Visit the nearby SBI branch and make the payment in cash over the counter.

-

The bank will charge a certain amount if you choose this method.

Electronic Drop Box

Drop a cheque in any electronic drop box of the bank and pay your credit card bill. An instant receipt would be sent acknowledging the payment. The cheque should be addressed to your SBI credit card account. Just find an SBI electronic drop box near you and drop the cheque.

Manual Drop Box

Drop a cheque at any of the 500+ SBI drop boxes in India. Enter your SBI credit card number on it. Also mention your name and a contact number on the back of the cheque. The payee name should be the 16-digits of the SBI credit card number.

ATM Funds Transfer

Locate the nearest SBI ATM, use your SBI debit card and pay your SBI credit card due.

NEFT at SBI branch

Visit the nearest SBI branch and pay your SBI credit card due through NEFT using the IFSC code SBIN00CARDS.

Autopay of SBI Credit Card Bill

Provide a standing instruction to the bank for auto debit of your SBI credit card dues. You can either choose to pay the total or the minimum amount due every month. Contact your bank to register for the autopay facility. The payment gets auto-debited on/before the due date every month.

Payment Processing Time for the SBI Credit Card Payment Methods

|

Payment method |

Processing time |

|

Online SBI |

Instant |

|

Paynet-Pay Online |

Instant |

|

Mobile Banking |

Instant |

|

SBI Debit card |

Instant |

|

Net banking |

Instant |

|

UPI |

Instant |

|

NEFT |

3 banking hours |

|

ATM funds transfer |

2 working days |

|

Over the counter payment |

2 working days |

|

Visa Credit Card Pay |

3 working days |

|

Paytm |

3 working days |

|

Electronic bill payment |

Within 3 working days |

|

Electronic Drop Box |

4 working days |

|

Manual Drop Box |

4 working days |

|

SBI Auto debit |

The payment gets credited on the payment due date |

|

National Automated Clearing House |

The payment gets credited on the payment due date |

FAQs

What is the amount charged if I choose to pay my SBI credit card bills at the SBI counters?

You would be charged Rs.100 + service tax. Also, the maximum cash amount that can be deposited per transaction is Rs.49,999. There is no charge for cheque payments/payments through funds transfer.

Which other bank debit cards offer an auto-debit payment option to pay SBI credit card bill?

Citibank, Bank of India, Bank of Maharashtra, Indian Overseas Bank, IDFC First Bank, Pragathi Krishna Gramin Bank, Kerala Gramin Bank, Shivalik Bank, and Bank of Baroda are the banks that offers auto-debit payment option.

Will I be charged if I choose to use cheque as the mode of payment to pay my SBI credit card bill through cheque?

Yes, a charge of Rs.100 must be made if the payment is done through cheque for an amount less than or equal to Rs.10,000. No fee would be charged if the payment is greater than Rs.10,000.

What should I do if the amount is not credited to my SBI credit card account but debited from my savings bank account?

In such cases, you can contact the customer care center of SBI or share the bank certificate issued by your bank after confirming the transaction to the following address:

SBI Card & Payment Services Private Limited

P.O. Bag No.28, GPO, New Delhi - 110001

What is the meaning of 'Without bills' when I make a payment on my SBI credit card through OnlineSBI?

'Without bills' is when the statement is generated for your SBI credit card and the details are not linked to your SBI bank account automatically. You must check your dues on sbicard.com. Then, you have to enter the amount manually on the OnlineSBI website every time in order to pay.

What's the process of application for SBI credit card?

Visit the bank website and choose from the several options of credit cards offered by them. Once you qualify their eligibility criteria, either apply for it online or go to the nearest branch and get assisted by a sales agent or representative there.

How can the status of credit card application be checked?

After the submission of application, a reference number will be sent to your registered mobile number. Through that number, you can track the status of the application on the bank's website after entering the reference number and other personal details.

What should be done if the payment has been done but it's not reflecting in the account statement?

In this case, please inform the bank that you have already made the payment and also make a list of the documents as proof to show them. Along with that, you may also file a dispute with bank.

If the payment has been made on the due date, will it be considered as a late payment ?

Yes, it might be, depending on the terms and conditions of the bank. If the offered terms clearly say that the payment made on the due date and after will be considered late, then the bank will consider such payments as delay. Moreover, if a cheque payment is made on the due date, the payment might not be cleared immediately, thus resulting in a late payment. It's always better to pay the outstanding amount a few days before the last date.

®

®