Indian Overseas Bank Credit Card Bill Payment

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

Credit Card Bill Payment Options for banks across India

Indian Overseas Bank Credit Card Bill Payment

IOB issues Credit Cards to the users for enabling them to borrow funds from bank to pay for daily expenditures like utility bills, mobile bills or buying other goods and services on the stipulation that user will pay back the amount to the bank with an additional interest.

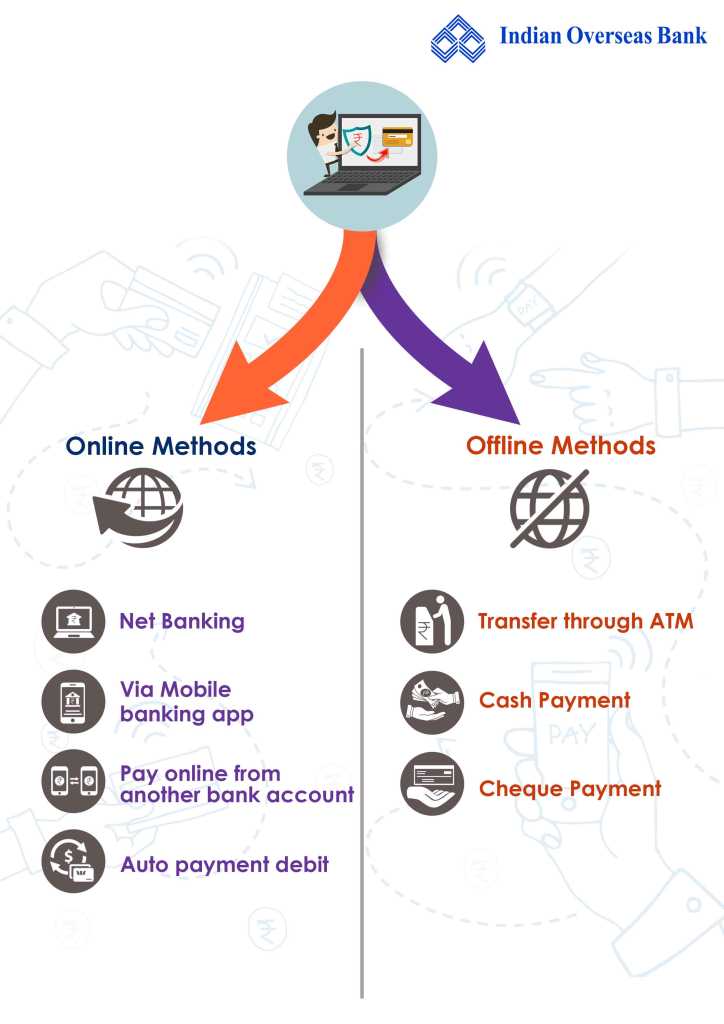

Indian Overseas Bank has customised credit cards to cater various needs of people whether it is for shopping, travel, hotel or corporate cards. There are different rewards and benefits associated with IOB, in which some cards have great cashback schemes as per transactions while some cards offer good amount of reward points which can be redeemed later for getting good offers from bank. IOB provides multiple options in both modes of payment, online and offline to its customers.

-

Online Method

-

Offline Method

Online Method

-

Indian Overseas Bank Net Banking:

Net banking facility can be availed by users only after registering online. To check the outstanding of credit card and paying bills, user is required to link credit card with net banking account for which ATM pin details would be used. After linking IOB credit card with net-banking account, user would be able to check billed or unbilled transactions, due dates, reward points by simply logging in the net banking account through bank's website, clicking on "Credit card" tab and selecting "Credit card payment option". IOB is also providing hot listing facility under net banking in case if the card has been lost or stolen to block it from getting used by charging fee of Rs.100.

-

IOB Mobile App:

For this procedure, users need to download and install IOB app in their phones. After installation users can logon to app by using customer id. App has been made for the convenience of mobile users having same features as that of net banking portal, so that it may be accessible from anywhere. Credit card accounts are highly secure using SSL protection of 128 bit due to which a user can conduct transactions safely from anywhere using their accounts through mobile app.

-

Auto payment debit:

If a user is having multiple credit cards, auto debit option on bank account is an option of payment for which certain instructions need to be set on IOB account. This facility is used to pay minimum amount or for repaying the outstanding balance. Either the account should be handled by a single user or it could be used as joint account.

-

Credit card payment from non-IOB accounts:

It is not mandatory to have an account in the same bank, whose credit card you bought. There are different ways of paying credit card bills through other bank accounts:

-

NEFT method: In this method user need to enter number of IOB credit card as the payee account number to make payments and the IFSC code. The payments which are made during working hours on weekdays get transferred on same day whereas the payments which are made after working hours get transferred on next day.

-

RTGS (Real time gross settlement )method: This method is applicable for the people who use credit card for higher transactions as they can pay the whole amount at one time, so a payment of Rs2 lakhs or more can be done at one click unlike NEFT where for higher transactions payment has to be done in batches. For carrying out this transaction net banking should be activated in other bank account too.

-

Bill desk webpage : Bill desk page can be used by non-IOB holders also as it has been set for IOB account holders. The user need to enter the necessary details like the card number and amount after which the user will be redirected to net banking portal for completion of transaction.

-

Offline Method

-

Cash Payment:

Credit card bills can be also be paid at the nearest bank branch of IOB by paying processing fee.

-

Cheque Payment:

Credit Card bill payment can also be done through cheque by dropping it at the nearest ATM, after writing the credit card number and other details on it.

-

Transfer through ATM:

IOB credit card bill can also be paid at any of the nearest branch ATMs .This service can be availed 24/7.Here the amount that is required to be paid can be transferred from saving or currents account to credit card.

Indian Overseas Bank credit card bill payment FAQ

If a wrong credit card number has been entered, what a customer should do in such case ?

Though the credit card number should be entered twice for security purpose but even then if it happens, please call the customer care.

How the offline payments can be made ?

It can be paid by cash or cheque either at nearest ATM or nearest bank branch.

How can credit card payment can be made through mobile?

For this process, please download the app and payment can be made in credit card section.

®

®