How to Check Your EPF Balance Online?

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

Now, the provision to review the EPF balance online makes it convenient for you and also helps you to be up-to-date about the funds in your account.

What is EPF?

Employees' Provident Fund Organization or EPFO is a government-run retirement body and runs three social security schemes:

- Employees' Provident Fund (EPF)

- Employees' Pension Scheme (EPS)

- Employees' Deposit Linked Insurance Scheme (EDLI)

EPF is the oldest of all these three schemes. Established in the year 1952, the EPF was initially created to support the industrial workers to build a stable source of income after retirement. But, then, the scheme was later extended to all the employees across different sectors. Subsequently, the government made it compulsory for all organizations who have more than 20 employees to contribute to the scheme.

If you wish to know your EPF balance, you can do it from the official website. However, to check it, one has to fill all the necessary details as per the required checklist from the website. Also, with advancement in technology, the EPFO has also included three more ways to check the EPF balance - missed call, SMS, online portal - to check the EPF balance.

How Does the EPF Work?

As per the EPF Act, 12% of your monthly salary is contributed to the EPF; the employer also adds the same amount. Besides, the funds collected in your PF account earns interest throughout the course of your employment. As of FY 2018-19, the rate of interest on an EPF account is 8.55% per annum, and you can withdraw everything on retirement. Ideally, you are supposed to withdraw your EPF contribution on retirement. But, the EPFO also allows partial withdrawal of funds but only under certain circumstances.

What are the Ways to Check Your EPF Balance?

Recently, the EPFO has introduced new ways for employees to check their EPF balance and are also developing different platforms that can be used in the future. The services currently available are:

- Missed Call

- Online Portal

- M-sewa app

- SMS Service

How to Check Balance in Your EPF Account?

The EPFO has integrated several technologically advanced platforms to offer seamless service to everyone. Moreover, the EPFO had also announced that it would become a digital platform by August 2018.

What are the Requirements to Check Your EPF Balance?

- UAN: The first and foremost is the UAN (Universal Account Number). In October 2014, Prime Minister Narendra Modi launched the UAN to create a unified identification number for everyone who contributes to the EPF. UAN is a 12-digit number that is unique to all employees and is allotted by employers. It also serves as a reference ID for the employees who hold more than one PF account. Once the UAN is allocated, the employees should ensure that their UAN is activated and create a password to access their EPF account information.

- KYC Verification: The second requirement is to complete your KYC verification for the UAN. It requires you to incorporate your UAN with PAN details, Aadhaar information, bank account details and mobile number.

Once all the requirements as mentioned above are fulfilled, you can check the balance in your EPF account.

Why is it Essential to Check EPF Balance?

Now, employees can check their EPF balance by many methods such as missed call, SMS, UMANG app, EPFO app and EPFO website/portal. Keeping a check on the EPF account balance can help manage your expenses; you can even use the EPF balance to avail loans. Through the EPF account, you can check your EPF balance and accordingly modify your debt investments. You also should check your EPF balance to ensure if withdrawals, claims, the settled amount from the EPF account, etc. are the same as the one that reflects on the EPF account passbook.

Check Your EPF Balance Using EPFO Online Portal

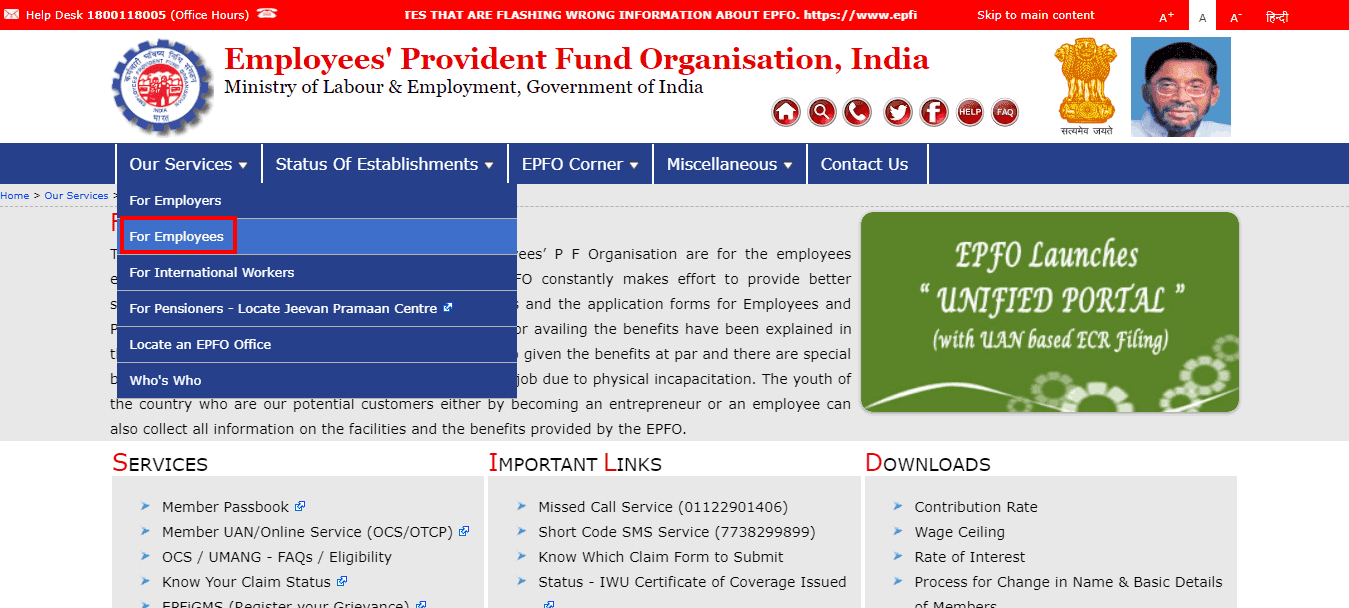

Here's a step-by-step guide to check the EPF balance on the EPFO portal, i.e., www.epfindia.gov.in:

- Visit the EPFO website.

- Click on 'Our Services' tab.

- Next, choose 'For Employees' option from the drop-down menu.

- Then, click on the 'Member Passbook' under the 'Services' option.

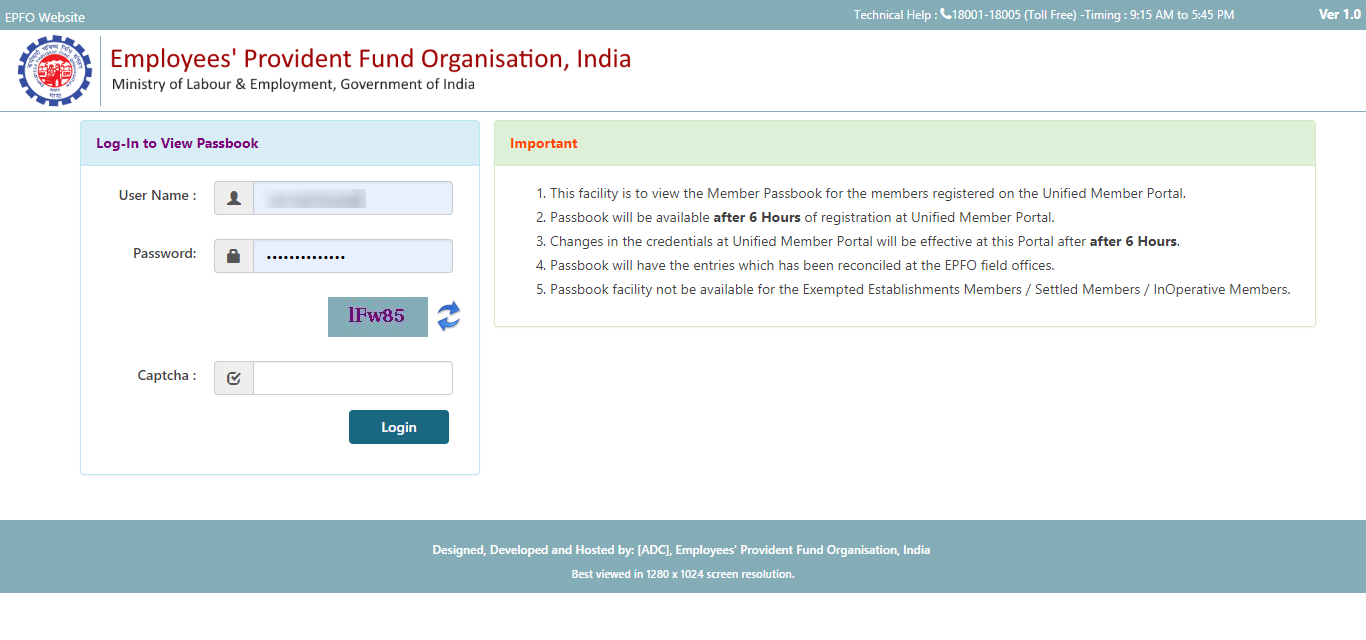

- After you come to the login page, enter the username and password accordingly.

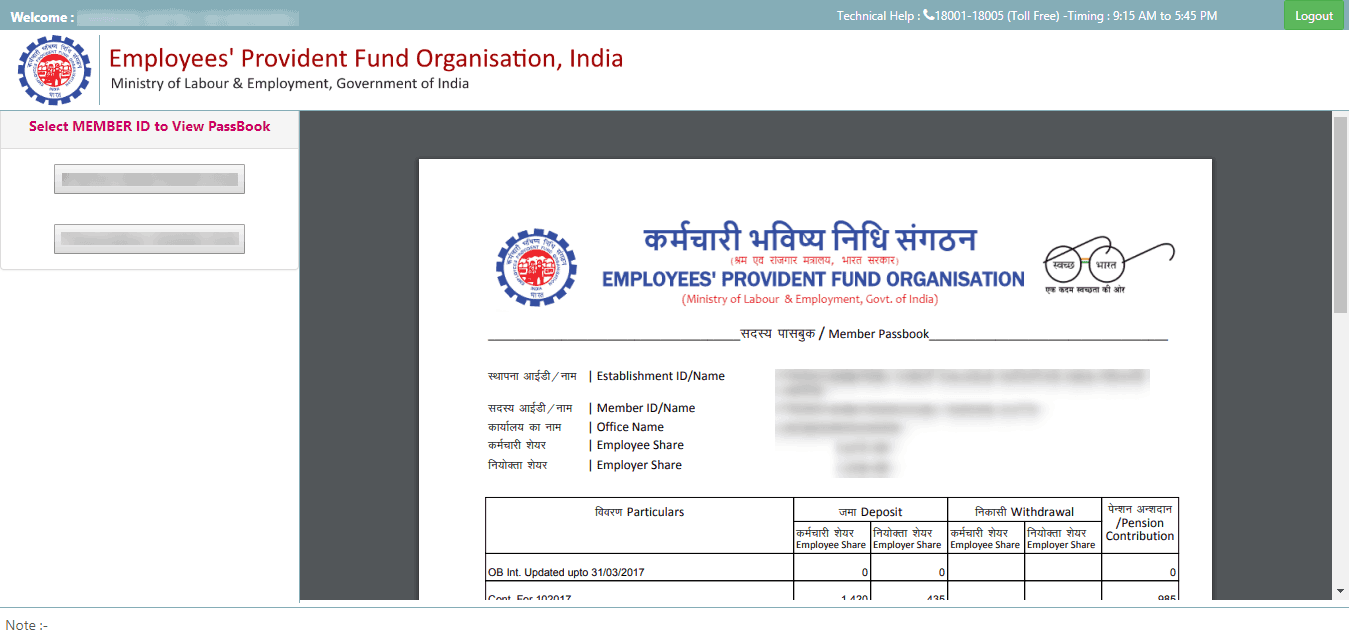

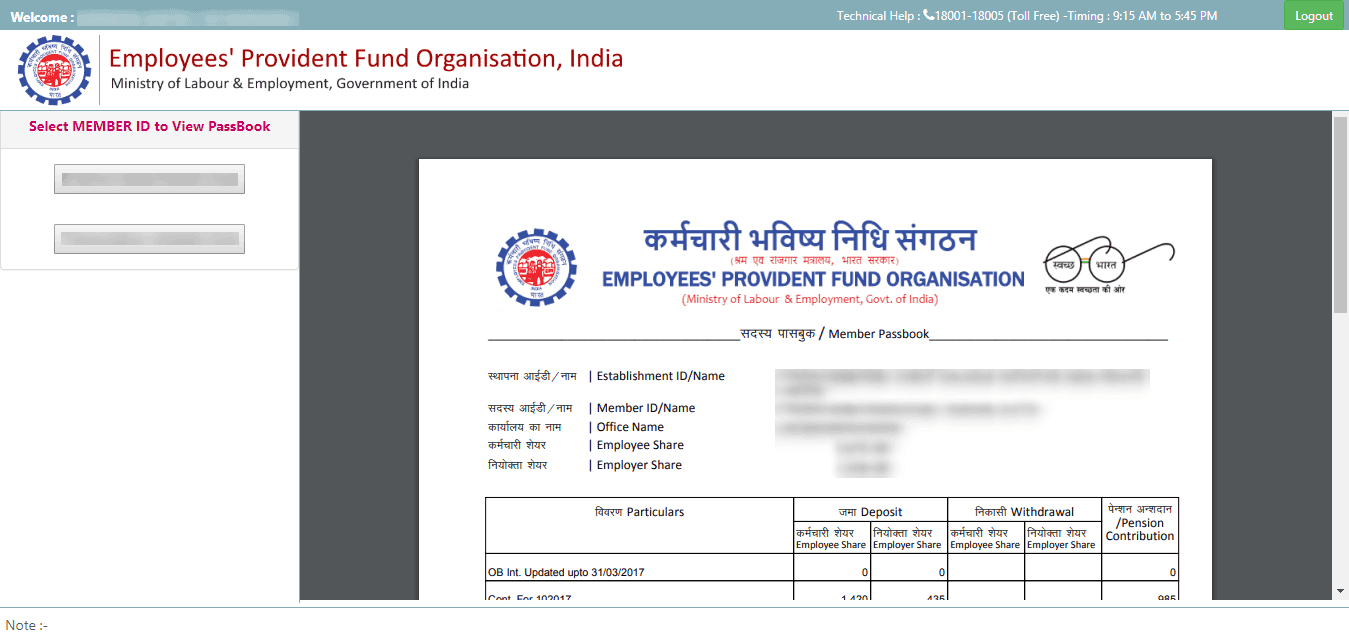

- After you have logged in, you can access your EPF details.

Then, you can click on the respective passbook to check your EPF balance with different employers.

Also, some employers and employees aren't eligible for the EPF facility. Therefore, it is always advisable to check for the eligibility criteria under 'Status of Establishments' on the EPF government website. To know more, click here:

https://passbook.epfindia.gov.in/MemberPassBook/Login.jsp

Check Your PF Balance via Text Message

If you have completed the KYC process, then you will be able to know all the details of your EPF account via SMS. To find out the EPF balance, you can send the following text to 7738299899: EPFOHO UAN ENG.

Moreover, you also have the facility to choose the language in which you want to receive the details. To enable the facility, the first three letters of the language needs to be included in the text after typing 'UAN.' This facility makes it convenient for those who do not own a smartphone or have no access to the internet. You will receive an SMS with all the details from UAN, including your Aadhaar, date of birth (DOB), PAN, and the ast contribution made to the total PF balance.

Check Your EPF Balance via Missed Call

As EPFO subscribers, you can also receive your account balance by giving a missed call to 011-22901406. However, you need to make sure to call from your registered mobile number to receive a detailed account balance. This facility is especially useful for people who do not own a smartphone or have access to the internet. It also cuts down the need to physically fill out the forms to obtain information.

Check EPF Balance Online Without Using UAN

Employees who haven't yet created their UAN can view the EPF balance using their PF account number, which can be found on the pay slip. For such people, you would have to log in to the EPFO portal and enter a few details, such as the state you reside in, mobile number, etc., to get a clear picture.

Check PF Balance via Mobile App

For users' convenience, the EPFO has now launched their very own mobile app. All of them first have to download the app, and then register themselves using their KYC details and PF account number and then follow these steps:

- First, download the app and then, click on "member."

- Next, enter your UAN and choose the balance/passbook option.

- Then, enter your registered mobile number.

- From there, choose the "EPF passbook" option if you wish to view the statements of the last seven months.

- Once you have entered all the details, you will able to see the balance.

Check EPF Account Balance on Smartphones

An Employees' Provident Fund Organisation (EPFO) subscriber can also use the UMANG app on smartphones to view the Employees' Provident Fund (EPF) for checking account balance, claim settlement, and even monitoring claim status. Here's a guide on how to check EPF account balance:

- Download the UMANG app.

- Next, enter the One-Time Password (OTP) for signing up on the UMANG app.

- Then, enter your Aadhaar number. As per government rules, Aadhaar linking is compulsory if you want to request online transfers or raise claims through the UMANG app.

- After all the initial formalities, the homepage of the app will display all the EPF options.

- Choose your service from the ones given - view passbook, claim request for pension withdrawal and track claim status.

- Then, enter the Universal Account Number (UAN), and you will receive an OTP on the registered phone.

- After entering the OTP in the app, the EPF passbook can be viewed and can also be downloaded in PDF format.

Check EPF Balance of Exempted Establishments or Private Trusts

In case of an exempted establishment or private trust, the EPF balance goes to the company managed trusts rather than the Employees' Provident Fund Organisation. Hence, only the company managed trust can reveal an employee's PF account balance. The EPFO does not provide any passbook facility for the employees of the exempted establishments.

According to the Employee Provident Fund and Miscellaneous Provisions Act of 1952, some employers can also manage their PF schemes for their employees. Exempted establishments are mainly companies like HDFC, Godrej, Nestle, TCS, Wipro, Infosys, etc. that have their in-house EPF trusts and are exempted from contributing their EPF to the EPFO. However, these trusts are expected to provide better or higher returns than the EPFO-managed fund, and the same rules apply to the EPF contribution made to these trusts.

Employees of exempted establishments can check their EPF balance in the following ways:

Check your PF slip or payslip: Most establishments provide pay slips to their employees. If you wish to check the balance, you can refer to your payslips for your EPF account balance.

Check the company's employee portal: Most of the large organizations maintain a company website where the employees can log in and check their EPF account balance listed in the EPF section.

Check with the company's HR department: Employees can also contact their company's HR department as it deals with the employees' PF and has better knowledge of such details.

Track your contributions: Employees can also keep track of their monthly contributions by checking their salary slips and thus easily calculate the annual EPF balance.

Steps to Find Out Your EPF Balance Using the UMANG App

- After downloading the app, sign in with your mobile number and Aadhaar number.

- Next, set up an MPIN.

- Enter the required details.

- Then, select the EPFO app from the list of other services.

- In the EPFO option, select 'Employee Centric Services.'

- Next, select the 'View/Download Passbook' option.

- An OTP will be sent to your mobile number

- Enter the OTP to view your EPF balance.

- You can also download a PDF copy of your passbook and print it if necessary.

What are the Features and Benefits of the UMANG App?

Employees enrolled in the EPF scheme can also carry out processes through the UMANG app. You can also download your EPF Passbook, make PF Claim (for withdrawals or settlements) and track the status of your claim. In case of claim settlement, you need to update your Aadhaar details to carry out the process.

People who are enrolled in the NPS (National Pension System) can also check the status of their account and the accumulation of their pension, account details, and all the contributions made towards the scheme. Those who receive a pension can also generate their digital life certificate or Jeevan praman through the UMANG app.

Citizens who are looking for a job can also register themselves under the Pradhan Mantri Kaushal Vikas Yojana through this app. For instance, the Government of Gujarat has integrated their Online Job Application System (OJAS) with UMANG to help people with job opportunities.

How to Check the EPF Balance via UMANG App?

Here's a step-by-step guide for checking EPF balance using the UMANG app:

The UMANG app was launched by the Ministry of Electronics and Information Technology, and it can be used to view EPF passbook, EPF balance, EPF claim settlements and status of EPF claims.

- You can download the UMANG app from the Google Play store or apple store.

- An OTP is sent to your registered phone number.

- Link your Aadhaar to the app for making a claim or any transfer requests.

- The homepage of the app has an EPF option after it is initialized.

- The 'Employee Centric Services' in the app gives options such as 'View Passbook,' 'Track Claim Status' and 'Make Claim Requests' for withdrawal of pension (full and partial withdrawals) and final settlement of the claim.

- To access the information linked with EPF, the user needs to provide the username (UAN) and the password (OTP) which is sent to the registered phone number.

- The EPF passbook can be downloaded and viewed in PDF format.

- The 'General Services' offered on the mobile app, UMANG includes:

- Search Establishment

- Search EPFO Office

- Know Your Claim Status

- Account Details on SMS

- Account Details on Missed Calls

- 'Employer Centric Services' include 'Get Remittance Details' by Establishment ID and 'Set TTRN Status'.

- The other services provided on the UMANG app are 'eKYC Services,' such as Pensioner Services and Aadhaar Seeding.

EPF Balance for Inoperative Accounts

According to a notification issued by the Indian Government in November 2016, the inactive accounts will continue to accrue interest, and it won't be characterized as inoperative. Employee's Provident Fund Organization had stopped crediting interest to inactive accounts since 2011. However, since the new amendment was passed, all inactive accounts have been receiving interest at the prevalent yearly rate. Earlier, accounts turned inactive mainly due to the cumbersome procedure involved in Employee Provident Fund transfer; also, employees were willing to open new accounts after they switch jobs. Due to the communication gap between the previous and current employers of an individual. In situations where the employees are unable to track details of their old inactive accounts, they can request the EPFO help-desk and get the funds transferred from the old EPF account to a current EPF account.

New EPF Withdrawal Forms for Easy Claims

The EPFO has released new forms that facilitate the withdrawal of provident fund amount without any employer attestation. These forms are known as:

- Form 19 UAN

- Form 10C UAN

- EPF Form 31 UAN

This decision by the government has considerably cut short the complex procedures involved in making claims and PF transfers. The new EPF forms are a big help. For the employees Now, they can apply for final claim settlement, full withdrawal, partial withdrawal and even loans against EPF from the comforts of their homes.

The Form 19 UAN is applicable in cases where an employee resigns from their service or employer terminates the employment agreement. The next Form 10C UAN is used for making claims which are related to EPS and Form 31 is associated with advances or partial withdrawals.

Preconditions for EPF Withdrawal Without an Employer Signature

- Valid UAN.

- Form 11 of the employee should already be available in EPFO records.

- Bank details and Aadhaar number seeded in KYC data.

Also, if an employee doesn't meet all the criteria as mentioned earlier, they will have to make claims using the regular EPF forms, i.e., Form 31, Form 19 and Form 10C.

EPF Customer Care

For the convenience of the customers, EPFO has launched various mobile and web-based services to solve all the account-related queries and help customers know their EPF status with ease.

You can call at 1800118005 and register your grievances. Besides, the PF regulator is also strengthening their social media presence to handle various complaints and requests from members through those channels. Currently, all the queries and grievances that come on both Facebook and Twitter handle of EPFO are attended within 24 hours by the officials of regional centers. The social networking platforms give an added support to the online public grievance addressing system of regional EPF centers.

By the end of each salary period, annual statements of PF accounts are available on the EPFO website; and anybody can download that through the E-sewa portal.

Steps to Download the EPF Balance Statement:

- Visit https://epfindia.gov.in/

- Next, in the EPFO home page, click on the link "For Employers."

- Then, under the services listed in the page, select "ECR/Challan Submission."

- It will take you to the "Employer E-Sewa" page.

- Next, click on the "Employer E-Sewa" link and sign in using your credentials.

- Finally, in the downloads tab, download the PF slips and if necessary take a print out.

®

®