ICICI Bank Mobile Banking

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

Almost everyone nowadays uses a smartphone. Thus, ICICI Bank decided to offer the convenience of a completely functioning banking facility to smartphone users. The mobile banking arm of ICICI Bank allows customers to perform innumerable banking transactions through their smartphones. Customers can not only view their account activity and account statements but can also open new accounts, transfer funds online, pay utility bills, make tax payments, purchase insurance, recharge on mobile phones and DTH connections, and do a lot more using ICICI Bank's Mobile banking feature.

Register Mobile Banking

You can follow the options mentioned below to register yourself for the Mobile Banking Service.

-

Register yourself for Mobile Banking at any ICICI Bank ATM.

-

Alternatively, you can visit your nearest ICICI Bank branch to register yourself for Mobile Banking. You would have to carry along identity proof to complete the registration process. Here is a list of identity proof documents accepted for Mobile Banking registration:

-

-

Original letter of introduction from existing bank

-

Employee Identity Card

-

Driving License - Book type or laminated & embossed

-

PAN Card

-

Photo Identity card issued by Public Sector Undertakings(PSU) to Retired employees

-

MAPIN card

-

Passport

-

Voter ID Card

-

Ex-Service Man Card

-

Bar Council/Indian Medical Association Card/Senior Citizen Card

-

PIO Booklet for returning NRIs

-

-

Once you have registered for the service, proceed to activating it.

Activate Mobile Banking

Follow these simple steps to start using iMobile:

Step 1: Download iMobile

Visit the Google Play store or iOS app store to download the iMobile application.

Step 2: Activate iMobile

Once the iMobile application is downloaded, follow these steps to activate iMobile

-

Open and install the application

-

Select the type of user you are.

-

Select the country code.

-

Enter the user ID and click on ‘activate.’

Features of ICICI Bank's Mobile Banking

iMobile – Being a comprehensive mobile banking app by ICICI, iMobile gives customers access to a myriad of financial services, facilities and transactions benefits. The extremely useful app gives you complete control of your bank account from the app itself. The iMobile app lets you transfer funds, pay bills, book tickets, recharge, open new deposit accounts and much more.

ICICI Bank Pockets – Pockets is ICICI Bank's Digital Bank service which offers several services. The prime service offered is that of a mobile wallet. You can park a certain amount of money in it which can later be used for online transactions such as funds transfer, bill payments, mobile recharge, etc. 'Pockets' gets you a zero balance savings account, and lets you access over 100 banking services.

SMS Banking – If you don't have a smartphone or don't have a data plan on your phone, you can avail all the Mobile Banking benefits by using SMS banking. It allows you to check your account balance and account statement and also generate a mini-statement by sending an SMS.

m.icicibank.com – This is the mobile banking website of ICICI Bank. It provides the convenience of banking while on the go. It has a user-friendly interface and is loaded with various convenient features. The iDirect feature allows you to manage your Demat portfolio; the iTrack feature lets you check the status of all your deliverables; the iLoan lets you observe your loan summary; the Instabanking feature gives you access to priority banking and paperless bank work.

Mobile Money – ICICI Bank introduced the new Mobile Money feature in which the user’s mobile number becomes an account. The bank offers this scheme in partnership with teleservice providers and enables customers to make use of a variety of services and features like depositing money, paying for a prepaid recharge, transferring funds, paying bills, withdrawing cash, paying for retail transactions, etc. Mobile Money includes m-pesa, mRupee, Aircel ICICI Bank Mobile Money and Oxigen e-Paisa.

Call To Pay – This is an easy to use service which allows customers to pay utility bills, recharge prepaid mobile phones or DTH connections by making a call.

NUUP – NUUP or the National Unified USSD Platform (NUUP) service by ICICI allows the customers to access their ICICI bank account from their mobile phones. This service does not require an active data pack on the phone. It doesn't even need a smartphone.

Benefits of ICICI Mobile Banking

The mobile banking facility of ICICI has plenty of advantages, which are especially beneficial in today's world where everyone heavily uses smartphones. These are the most notable benefits:

- You can monitor your account activity with ease.

- You can view your transaction history, account balances and carry out other several activities related to your account.

- Enjoy the advanced world-class security measures and encryptions that are applied to your transactions and account activity so that you can be assured that your funds are absolutely safe and secure.

- Pay bills for various utility services such as electricity, water, rent, mobile phone, etc. quickly and conveniently.

- Get access to many app-exclusive offers and discounts on transactions done through the app or the mobile banking services.

- Explore the benefits of the SMS Banking service and NUUP service, designed for customers without smartphones or without data access on their phones.

ICICI Bank Fund Transfer Options

The Mobile Banking customers of ICICI Bank can transfer funds not only to other ICICI Bank accounts but also to accounts in other banks through several options offered by the Mobile Banking services.

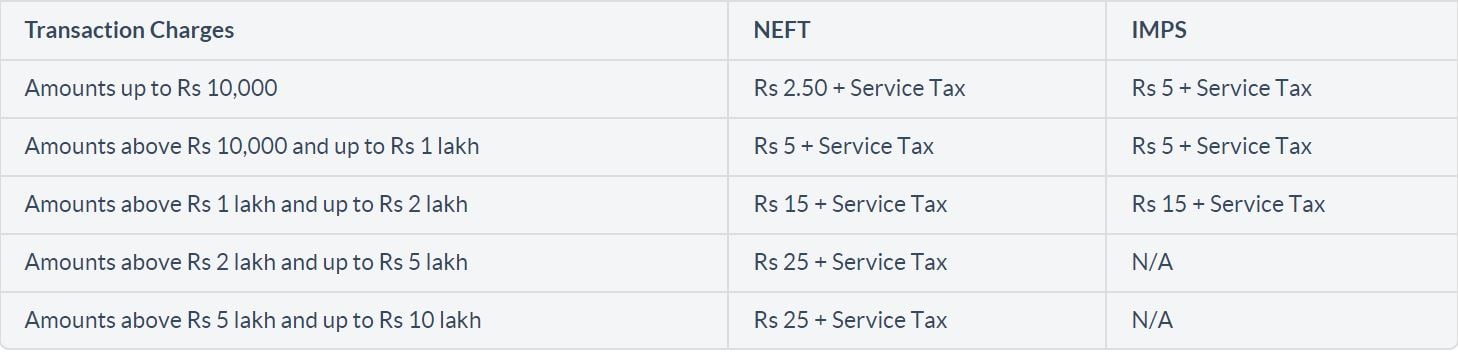

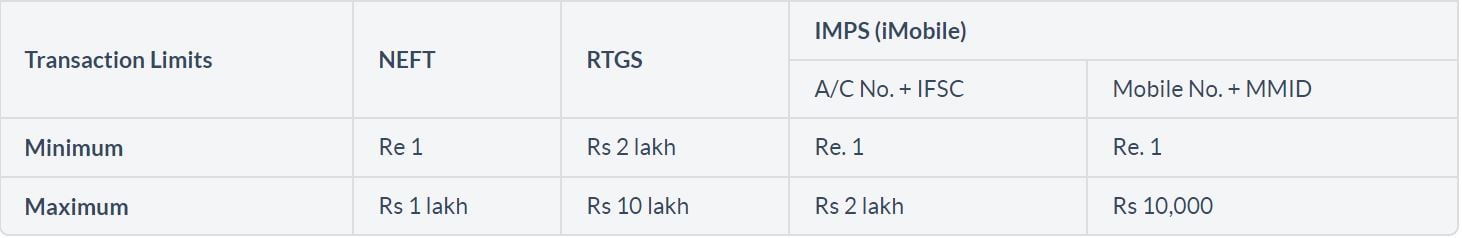

NEFT - National Electronic Fund Transfer system or NEFT is a mode of electronic fund transfer that works on the basis of DNS or Deferred Net Settlement at specific times of the day. In NEFT, the transactions are carried out between banks via payment instructions. There is no set limit for NEFT transactions done at the bank. However, there is a limit of Rs.1 lakh per day via Mobile Banking.

IMPS - Immediate Payment Service, as the name suggests, is an instant way of electronic fund transfer. It is mainly used for inter-bank transactions. ICICI provides the IMPS facility to all its customers who have registered for using online ICICI services. It enables you to send as well as receive money at odd hours and even on Bank Holidays. The transferred money is directly credited to the beneficiary account. You must add a beneficiary to make IMPS transfers. This service is available 24x7. A maximum of Rs 2 lakh can be transferred through iMobile using the account number and Rs 10,000 using the mobile number.

RTGS – Real Time Gross Settlement or RTGS transfer funds at the real-time, based on the received transfer instructions. The funds are individually settled as per instruction. RTGS happens to be the fastest way of interbank money transfer in our country. ICICI lets their customers transfer from Rs. 2 lakh to Rs. 10 lakh through RTGS. It is faster than most of the other methods and the settlement cycles are much quicker.

ICICI Bank Mobile Banking Security Measures

- ICICI has employed the most advanced and trusted security measures for Mobile Banking transactions.

- Sophisticated encryption technologies are used to ensure the safety of mobile banking safer transactions.

- Choose from two security options - either internet banking User Id and password or by using a 4-digit PIN - for logging into your account.

- No sensitive account data or related information is stored on your mobile phone.

- An additional level of security to actions and transactions through a grid verification for activating any feature or service.

®

®