Axis Bank Mobile Banking

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

Mobile banking has made life easier for us by adding convenience to our financial tasks through newer and more advanced banking services, accessible from anywhere through smartphones, tablets, laptops, etc. Axis Bank has also introduced its mobile banking feature which is a huge favorite among customers.

One can keep an eye on their accounts with Axis bank's round the clock Mobile Banking and SMS banking service. Axis Bank also offers added convenience by providing you with account information anytime anywhere by sending an SMS to +919717000002 and receiving the information in return.

How to Activate Axis Mobile Banking?

-

Download the app from the google store/app store.

-

If you are an axis bank user, then after installing the app, click on 'Login.'

-

The app will access your phone’s SMS inbox and send an activation SMS from your mobile number to the bank’s server. Make sure that the SIM with which you want to register is present in the device.

-

Axis Bank will take your consent to proceed before sending an activation SMS from your mobile phone. This SMS is chargeable as per your tele service provider’s mobile plan.

-

Once the bank verifies your details, the Axis Bank Mobile Banking App will get activated.

-

If you don't have an Axis Bank account and want to open one, then click on 'Try ASAP.'

-

Axis Mobile will again ask for your consent to send an activation SMS from your device to verify the details.

-

If your SMS reaches successfully, the bank will approach you for further information.

Steps to Register for Axis Mobile Banking

Step 1 - Setting an mPIN

-

On the Axis Bank app, click on 'Login.' An activation SMS will be sent from your Android phone with your consent to verify the details. If you have an iPhone, then click on 'Send' in message inbox to trigger the SMS.

-

Enter your name there.

-

Set an mPIN of your choice as per the bank's policy to complete the registration process.

-

Jot down this mPIN somewhere so that you may remember it while making transactions via Axis Mobile Banking app in the future.

Step 2 - User's Authentication

For using the features of Axis Mobile app, authenticate yourself first through any of the following two avenues:

-

Enter your Internet banking login ID and password if you are authenticating through net banking.

-

Enter your debit card number, its expiry date and PIN to authenticate through debit card credentials.

-

Please note: To go through the authentication process, your mobile number must be registered with the bank, and the same number can be used for logging on Axis Bank app.

Please adhere to these instructions:

-

The version of an operating system in Android mobile phone should be 4.4 and above, and 9.0 and above in iOS.

-

You should have sufficient balance and an active internet connection on your mobile while performing the process.

Features of Axis Bank Mobile Banking

Axis Bank's SMS Banking service provides you with information through Automatic Alerts and SMS Requests.

Automatic Alerts

You will automatically receive alerts on your mobile number that is registered with your account for every transaction made through Cards, Net Banking or Mobile Banking. In the case of joint savings accounts, both the account holders will receive these alerts.

Bill payments due: In case you have registered for bill payments, you will receive alerts on your registered phone, informing you that a bill is due for payment.

Non-transactional Service Request through SMS

Whether you are checking your balance or going through the last 3 transactions in your account or finding out the status of your cheques or keeping tabs on your demat account balances - all these are possible through Axis Bank's Mobile Banking. Just send an SMS with the specific keyword to the SMS Banking number +919717000002

You can request for the following information:

- Balance Inquiry

- Last three Transactions

- Customer ID

- Locate the nearest ATM

- Cheque Book Request

Its Benefits:

Safety: You are intimated of each debit and credit transaction, allowing you to stay updated at all times.

Convenience: You need not queue up anywhere to check your accounts.

Time-Saving: You do not have to travel to the bank's branches or ATMs to check of your account.

Updates: You can get automatic updates on bill payments and all scheduled payments on your cell.

Accessibility: You can access this service from anywhere in the world at any time.

Axis Bank Fund Transfer

Axis Bank allows various modes of fund transfer through its mobile banking feature:

NEFT

National Electronic Fund Transfer system or NEFT is a mode of electronic fund transfer that works on the basis of DNS or Deferred Net Settlement at specific times of the day. In NEFT, the transactions are carried out between banks via payment instructions. There is no set limit for NEFT transactions.

Axis Bank NEFT Charges:

RTGS

Real Time Gross Settlement or RTGS transfer funds at the real-time, based on the received transfer instructions. The funds are individually settled as per instruction. RTGS happens to be the fastest way of interbank money transfer in our country.

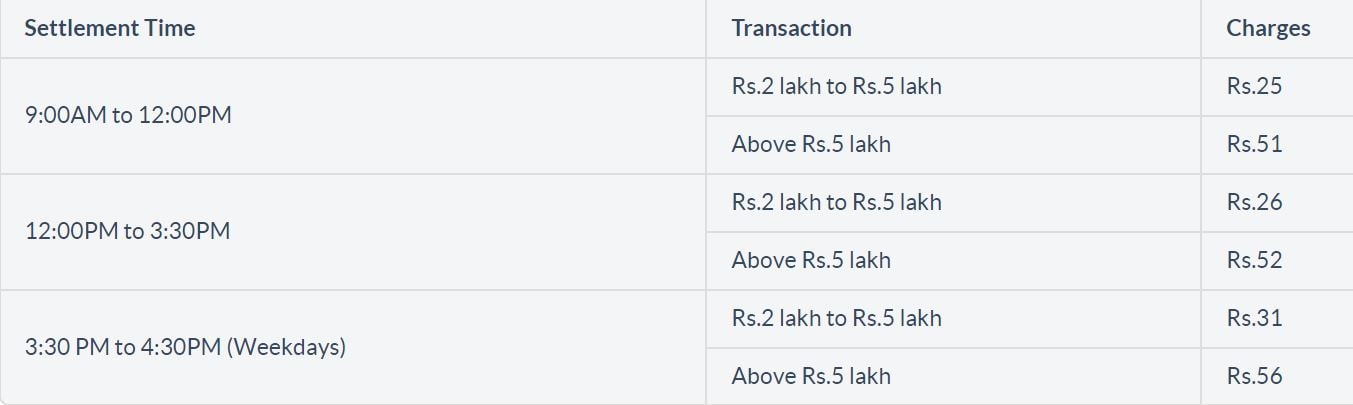

RTGS Timings and Charges:

IMPS

Immediate Payment Service, as the name suggests, is an instant way of electronic fund transfer. It is mainly used for inter-bank transactions. Axis Bank provides the IMPS facility to all its customers who have registered for using online services of Axis Bank.

Benefits of Using Axis Bank Mobile Banking

- Axis Bank’s Mobile Banking service gives you the access to anytime-banking through your phone.

- This facility is available to all the customers of Axis Bank with a savings or current account.

- Axis Bank's Mobile Banking services are completely free of charges, except the SMS charges.

- It is extremely safe and secure.

- Innumerable services can be availed through Axis Bank Mobile Banking.

- These services can be availed through all teleservice providers.

Axis Bank Mobile Banking: Security Measures

These are the security measures of the Axis Bank mobile banking service:

- If your phone is ever misplaced or stolen, your account information remains safe as your information is neither saved on your SIM card nor your mobile phone. It is better to call the customer service to report the theft and deactivate your IPIN.

- If you enter an incorrect IPIN a number of times consecutively, the pin gets blocked by Axis Bank.

Axis Bank Mobile Banking: Do’s

- Secure your mobile phone with a unique password, which is not to be shared with anyone.

- Choose a strong password containing a mix of alphanumeric and special characters.

- Change your password frequently to ensure safety.

- Report the incident to the bank and the nearest police station without delay in case of theft or loss of your phone.

Axis Bank Mobile Banking: Don’ts

- Mobile banking can be quite risky since you access these services while on the move. Do not hurry while entering the details.

- Don't share confidential information on any other website, except the registered bank’s app.

- Never share any banking-related information on your phone.

- If you happen to change your mobile number, you must inform the bank immediately.

- Avoid using mobile banking while on a public network.

®

®