Syndicate Bank Savings Account

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

Headquartered in Manipal, Karnataka, Syndicate Bank was established in 1925. It is one of the oldest commercial banks in India which has a strong presence in the semi-urban areas. It had sponsored the first regional rural bank, known as Pratham Bank, in 1975. Syndicate Bank has more than 3000 branches within India.

Types of Syndicate Bank Savings Accounts

SyndSamanya Savings Account: This account has zero balance facilities and allows the customers to enjoy the benefits of a savings account without having to maintain a minimum account balance. It is a fully KYC compliant account. Account holders can enjoy local cheque collection at no charge. They are eligible for a free chequebook if they can maintain a minimum balance as stipulated by the bank.

Premium Savings Account: This account offers a number of privileges as well as a lot of add-on benefits. Available at branches along with net banking facility, this account offers the customers the auto-sweep facility which converts excess balance in the account to fixed deposits. Account holders can liquidate this deposit whenever they want at free of cost. The excess balance is swept out in multiples of Rs. 1000 into 180 days fixed deposits. Account holders receive a handsome interest on the auto-sweep amount at the prevailing interest rate for deposit accounts.

Special Premium Savings Account: Customers with this account can avail the perks of a savings account as well as the high-interest rate of a fixed deposit. Account balance exceeding Rs.20000 is swept into a fixed deposit carrying attractive rates of interest. Customers can break this deposit whenever they are in urgent need of funds without having to pay a penalty charge.

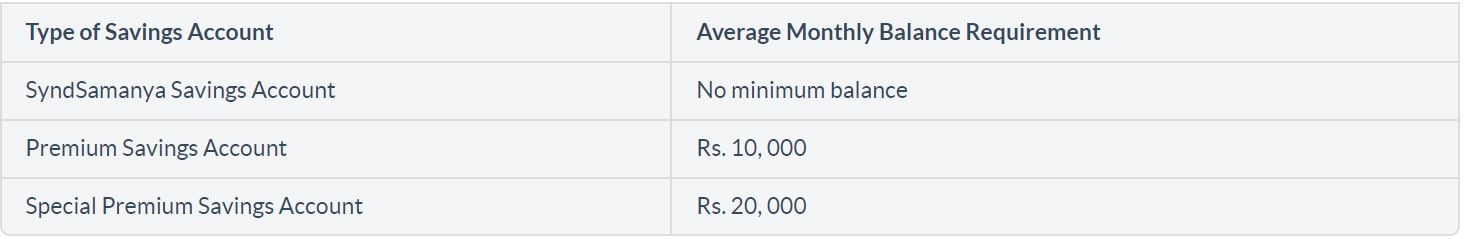

Syndicate Bank Savings Account Minimum Balance Requirements

Eligibility Criteria

A Syndicate Bank Savings Account can be opened by:

- Indian residents above the age of 18.

- Hindu Undivided Families.

- Trusts, associations, clubs.

- Minors can open a joint account with a parent or a guardian until they become adults and take autonomous control of the account.

Documents Required to Open a Savings Account

- Identity Proof: Passport, driver’s license with validity, Permanent Account Number (PAN) card, Voter ID card, Aadhaar Card, Government-issued photo identity card, NREGA Card, etc.

- Address Proof: Passport, driver’s license, Passbook of another bank, Electricity or phone bills, Ration card, etc.

- Passport sized photographs

®

®