Online Banking

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

Online Banking: Introduction

Online Banking or net banking or e-banking is the facility that banks and financial institutions provided which enables customers to use banking services via the internet. These include a number of services such as online money transfer, opening a new savings or deposit account, payment of bills, tracking account activity, etc. These facilities are made available to the customers through online banking. Online banking also lets the banks advertise their products and services in such a manner that it reaches out to millions of customers. However, an individual needs access to the internet in order to use online banking facilities. Internet banking facilities can also be accessed through mobile phones with a data 3G or 4G connection.

Online Banking Services: Scope

Online banking makes several indispensable services available to customers, without having to visit the bank personally. Customers can make financial transactions like transferring funds online, paying bills, applying for loans and opening a new account as well as various others. Internet banking facility lets a customer do several non-financial transactions as well. Customers can use the online banking facility to apply for a new cheque book, get account statements, update their contact information and start/stop payment, etc. It saves them the hassle of visiting the bank for such simple work.

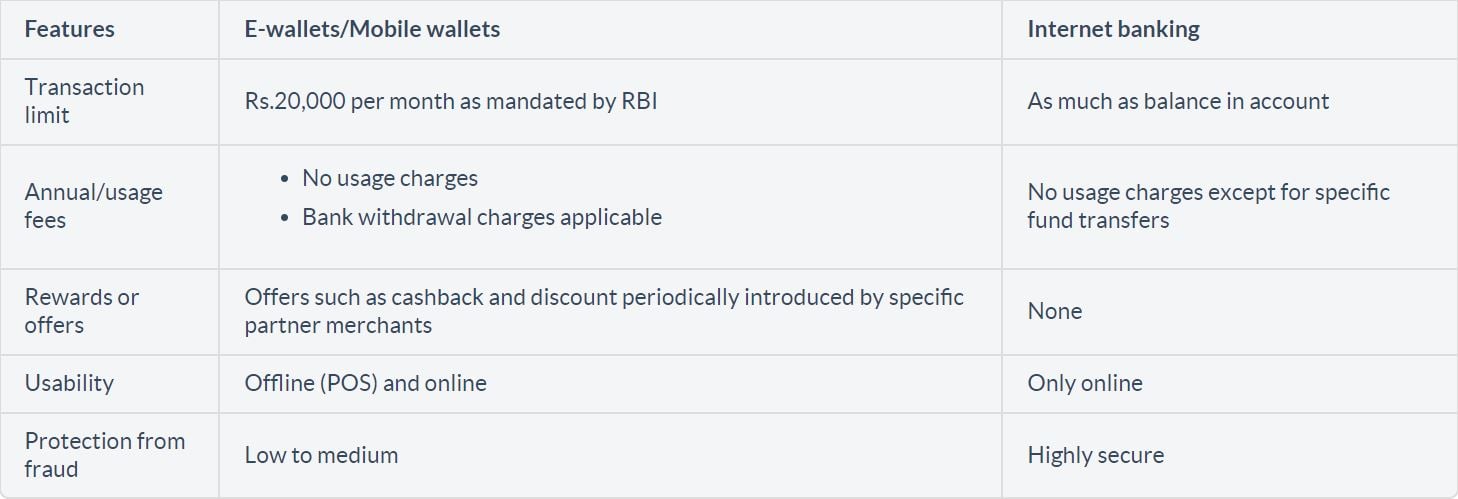

E-wallets Vs Net banking

2016 saw the demonetization of high currency notes and digital payments have seen a surge ever since. More and more customers have realized the convenience of digital payments. Mobile wallets and internet banking facilities have highly flourished as a part of a cashless economy.

E-wallet: Introduction

An e-wallet or a mobile wallet is a virtual digital wallet in which you can save your funds to use it for transactions without having to swipe your debit or credit card. It is a highly efficient and fast mode of transaction and it does not require any minimum deposit amount. One can use e-wallets to purchase anything, be it groceries or flight tickets. E-wallets can be downloaded for free on your smartphone. There are many companies offering e-wallet facility.

Using an e-wallet

The primary requirements for using an e-wallet is a smartphone with an active internet connection. You must download a wallet service provider and sign up for the wallet by filling in the required details such as name and mobile number. After logging in, you can easily transfer money into your wallet by using net banking or your debit/credit card. According to RBI’s latest mandate, you can add up to Rs.20,000 into the e-wallet.

Using Internet banking:

Most online payments can be easily done by using the internet banking option. It is an extremely convenient method for transferring money. Most banks have launched their own apps which can be downloaded for free on the phone and used for such convenient transactions. Customers can easily carry out banking transactions by using the net banking facilities, or by using internet funds transfer services such as IMPS (Immediate Payment Services), RTGS (Real-time Gross Settlement) and NEFT (National Electronic Fund Transfer) by using the mobile apps on their mobile devices.

E-wallets Vs. Internet banking:

Both e-wallets and internet banking services are digital payment platforms, but they have some difference.

Net Banking: Advantages

In this modern era, we are heavily dependent on technology, and internet banking is indeed a savior. Internet banking saves us the hassle of visiting the bank and standing in queues as required by conventional banking. Here are a few benefits of internet banking that makes our life easier each day.

Convenient to operate – Online banking is indeed quite simple and easy to understand as well. At times it is probably easier than conventional banking. Operating an online account is very straightforward and comfortable.

Making payments – Internet banking makes it very convenient to conduct transactions like transferring of funds, paying bills, etc. Customers are spared from waiting in queues to pay bills and then safely keeping the perishable receipts of the bill, as online transactions automatically save an e-copy of the bill which is non-perishable.

Available round the clock – A great advantage of online banking is that it is available at all the time, on all days, throughout the year. You need not schedule a time to carry out banking activities - you can do it at the weekend, at any time of the day, even at midnight or even on holidays.

Time-saving and efficient – E-banking is quick as well as highly efficient as it lets you carry out transactions in a jiffy. Transferring funds, opening accounts, paying bills and similar activities take less than a few minutes to process when done through internet banking. It saves a lot of time.

Tracking account activity – Internet banking allows you to track your account activity. You can keep tabs on all account transactions and check your account balance at all times. In this way, you can spot any unauthorized transaction or discrepancy immediately and reported the same to the bank right away. It allows you to keep your money safe always.

Internet Banking: Disadvantages

Online banking has a lot of advantages, but it also comes with a few disadvantages:

Complicated for beginners – If you are new to the world of banking, using internet banking might pose a slight challenge. Some banks provide usage tutorials and demos on their websites, but banks don’t do that. In case there isn't any usage instruction available, inexperienced users might be left to fend for themselves.

Mandatory internet access – Internet banking cannot be accessed without a stable internet connection. People living in remote locations cannot avail this facility. Also, customers will be unable to access their account online to carry out transactions if the bank servers are down.

Transaction security – When you are accessing your bank account information online, there is always a slight risk of data breach or identity theft. Most major banks have a powerful security encryption to ensure the safety of customer’s transactions. However, there have been certain instances where transaction details of customers have been compromised. It is quite uncommon, but still possible.

Securing the password – It is crucial to secure passwords for internet banking accounts. A user must set an inscrutable password and never reveal it to anyone. It would be ideal to memorize the password and keep changing it frequently, to prevent password theft.

®

®