Low Interest Rate Salary Loan

Tom is a young guy who has recently joined an IT firm. He gets a decent salary and lives a frugal life. He follows a strict budget as he has a gigantic education loan. He is barely left with extra cash after paying for rent and utilities. Tom also happens to be slightly forgetful. He somehow forgot about a yearly premium toward his medical insurance which was due on the 25th of June. He remembered it on the eleventh hour when he was helplessly out of cash. 29th was his payday and he had absolutely no extra money till then. Poor Tom! How he wished for an advanced receipt of salary!

Click on the button below to proceed to choose a bank, and get to know about the loans available at the cheapest interest rates.

Several events and expenses crop up in our lives that take their own course - a sudden invitation, a promotion party, an unplanned yet inevitable purchase or a family emergency. We can neither postpone nor ignore such financial plights. However, you might not be financially equipped to tackle them.

A responsible financial habit is determined by a profound sense of planning and budgeting so that you don't ever run out of money. However, young professionals might not always be very prescient; one may forget about a particular expense and fall short of cash during the time of payment; one might chance upon an unexpected expense; one might meet with a financial crisis. How would you rescue yourself if you were in such a situation?

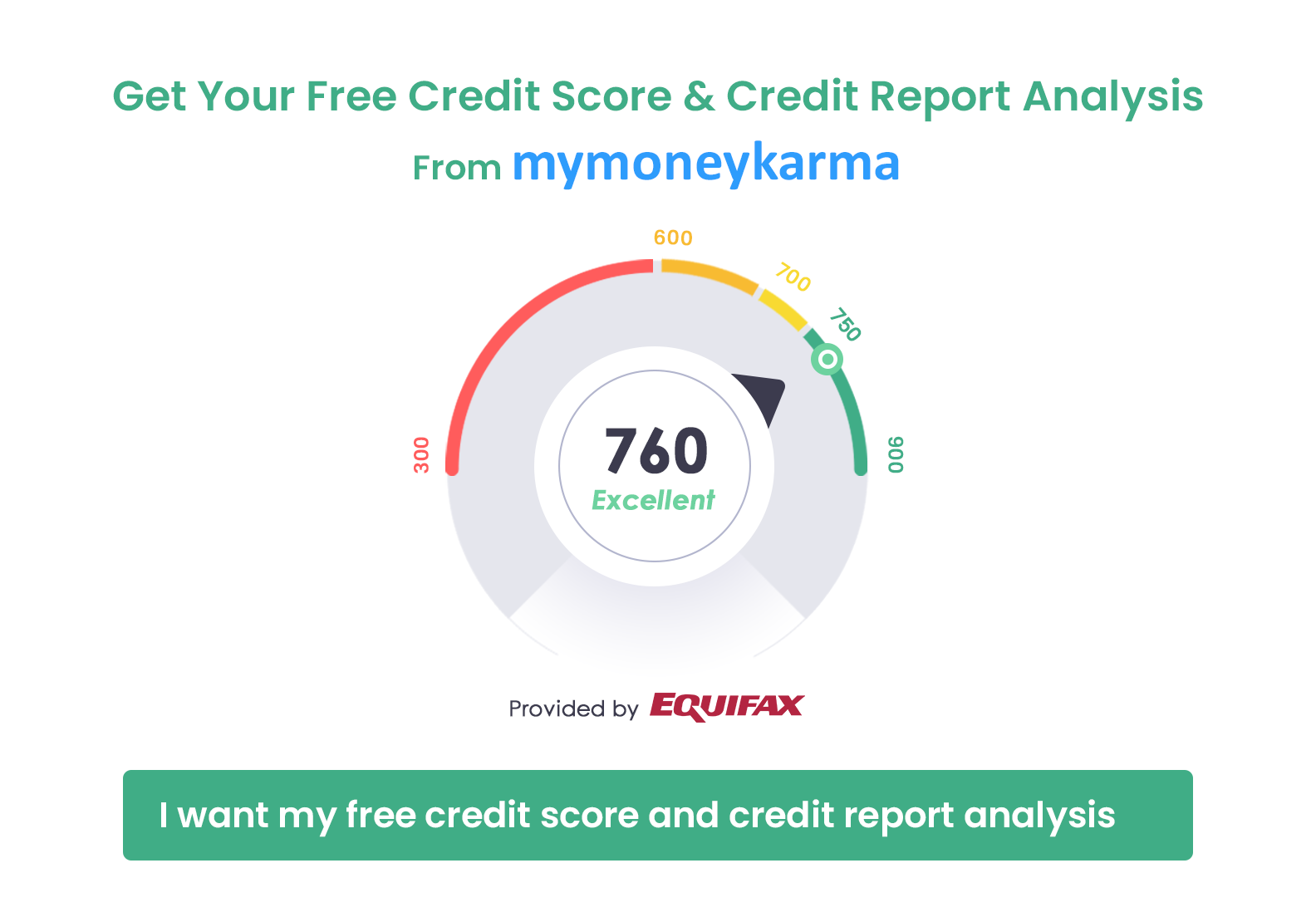

Get your free Credit report that cost Rs 1200 for FREE

1. Build your Credit Score

2. Reduce your Current Borrowing / EMI Costs

Advance salary loans help you manage these tough times of financial crunch when your salary does not seem to come early enough or when you are poorly out of cash before the payday.

Advance salary loans are small, short-term, unsecured loans that are generally disbursed by NBFCs using the P2P lending model in India. The NBFCs facilitate people with excess funds to lend it to individuals who are in need of it. It is sort of an investment for the lenders, who get to grow their money while the borrowers get access to funds during their times of need. An applicant must fulfill certain eligibility criteria in order to qualify for an advance salary loan. The lending institution checks the borrower's credit history, the amount of salary that you draw each month, the reputation of the company you work for and your current financial obligations before approving a loan.

Almost all NBFCs work on an online platform and one may apply for an advance salary loan online. In fact, the entire process of application, approval and disbursal of the loan takes place online. The required documents are either uploaded on an online portal or physically collected by an agent. An advance salary loan can be of a very meager amount, taken for just a couple of days. The interest and tenure are accordingly decided. The recovery of the loaned out amount happens through EMIs in which borrowers repay the amount within a month or over a period of a few months. A borrower may also pre-close the advance salary loan as soon as they receive their regular salary.

Instead of informally borrowing money from friends or family, you could take ownership of your own troubles and solve them with a formally obtained advanced salary loan.